Diversifying Wealth: Stock Portfolio Strategies in the USA

Building a robust stock portfolio is a fundamental aspect of wealth management, and in the dynamic landscape of the USA stock market, strategic planning is essential. In this article, we explore effective strategies for constructing and managing a successful stock portfolio, emphasizing the importance of diversification and tailored approaches for investors in the USA.

At Stock Portfolio USA, investors can access tools and insights to optimize their portfolio for long-term success.

Understanding Portfolio Diversification: A Key to Risk Management

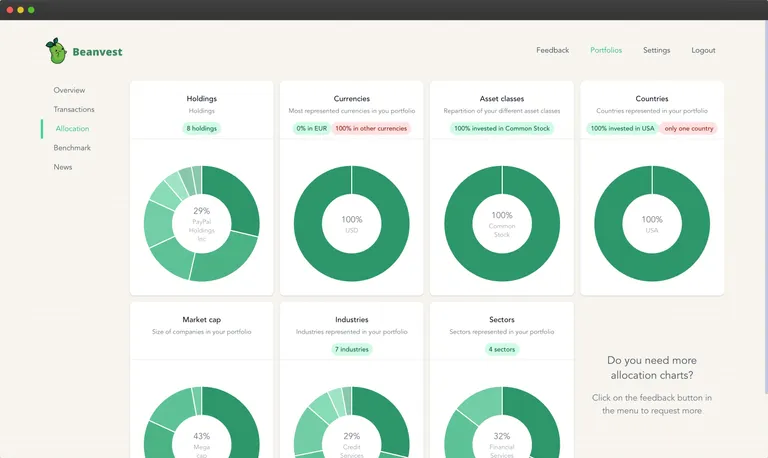

Portfolio diversification is a cornerstone of successful investing. This section delves into the concept of diversification, explaining how spreading investments across different asset classes, industries, and geographic regions helps mitigate risks. Diversified portfolios are better positioned to weather market fluctuations and economic uncertainties.

Strategic Asset Allocation: Balancing Risk and Return

Strategic asset allocation involves determining the ideal mix of asset classes based on an investor’s risk tolerance and financial goals. This paragraph explores how a well-thought-out asset allocation strategy helps balance risk and return, ensuring that the portfolio aligns with the investor’s investment horizon and objectives.

At Stock Portfolio USA, investors can find resources on strategic asset allocation for optimizing their portfolios.

Sector Rotation Strategies: Capitalizing on Market Trends

Market sectors experience different cycles of growth and decline. This section discusses sector rotation strategies, where investors adjust their portfolio allocations based on prevailing market trends. By identifying sectors poised for growth and reallocating accordingly, investors can capitalize on market dynamics and enhance overall portfolio performance.

Quality Stock Selection: Emphasizing Fundamental Analysis

Quality stock selection is critical for portfolio success. This paragraph highlights the importance of fundamental analysis in evaluating individual stocks. Investors should consider factors such as financial health, earnings potential, and competitive positioning when selecting stocks for their portfolios. Quality stocks form a solid foundation for long-term investment success.

Dividend Investing: Generating Passive Income

Dividend investing is a popular strategy for those seeking a steady income stream. This section explores how including dividend-paying stocks in a portfolio can provide a consistent source of passive income. Dividends not only contribute to overall returns but also add a layer of stability, making them an attractive component of a diversified portfolio.

At Stock Portfolio USA, investors can explore a curated selection of dividend-paying stocks for income-focused strategies.

Risk Management Techniques: Protecting Portfolio Value

Risk management is an integral part of portfolio management. This paragraph discusses various risk management techniques, including setting stop-loss orders, using options, and incorporating defensive assets. Effectively managing risks helps protect the value of the portfolio, especially during periods of market volatility.

Market Timing vs. Time in the Market: Navigating Investment Horizons

Timing the market is a challenging task, and this section explores the age-old debate of market timing versus time in the market. Investors are reminded of the benefits of a long-term perspective, focusing on the duration of their investments rather than attempting to predict short-term market movements. Time in the market has historically proven to be a more reliable strategy.

At Stock Portfolio USA, investors can access insights on navigating investment horizons for optimal results.

Regular Portfolio Rebalancing: Adapting to Changing Conditions

Market conditions change, and portfolios should adapt accordingly. This paragraph emphasizes the importance of regular portfolio rebalancing, where investors adjust their asset allocations to align with changing market dynamics and their evolving financial goals. Rebalancing ensures that the portfolio remains in line with the investor’s original strategic objectives.

Continuous Monitoring and Review: Staying Informed

Successful portfolio management requires continuous monitoring and review. This section discusses the significance of staying informed about market trends, economic developments, and changes in individual stocks. Regular reviews allow investors to make informed decisions, identify opportunities, and address any necessary adjustments to the portfolio.

Conclusion: Building Wealth through Strategic Stock Portfolio Management

In conclusion, building wealth through strategic stock portfolio management is a journey that requires careful planning, diversification, and adaptability. From understanding the principles of diversification to implementing risk management techniques and staying informed through continuous monitoring, investors can navigate the complexities of the USA stock market with confidence. Exploring opportunities at Stock Portfolio USA equips investors with the tools and insights needed to construct and manage a successful stock portfolio tailored to their financial objectives.