Driving Economic Equity: Financial Inclusion in the USA

Financial inclusion is a cornerstone of a thriving economy, ensuring that all individuals, regardless of their socioeconomic background, have access to essential financial services. In the United States, efforts to foster financial inclusion are gaining momentum, aiming to bridge gaps and create a more equitable financial landscape.

Understanding Financial Inclusion

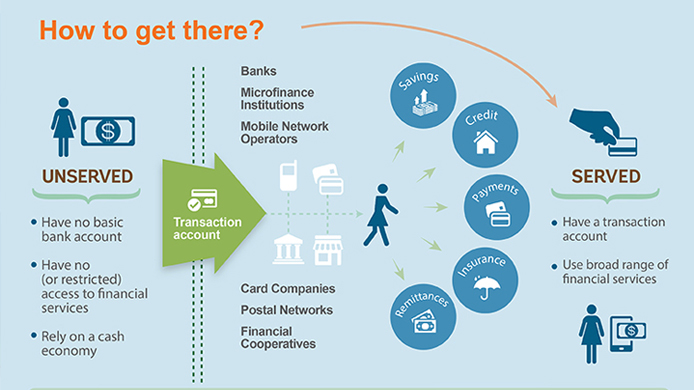

Financial inclusion goes beyond traditional banking services; it encompasses access to a range of financial products and services, including credit, savings, insurance, and payment systems. The goal is to empower individuals to manage their financial lives effectively, fostering economic stability and resilience.

Challenges to Inclusion in the USA

Despite advancements in the financial sector, challenges to inclusion persist. Some individuals, particularly those in underserved communities, face barriers such as limited access to banking infrastructure, lack of financial education, and credit constraints. Addressing these challenges is pivotal for achieving comprehensive financial inclusion.

Community Development Financial Institutions (CDFIs)

CDFIs play a crucial role in promoting financial inclusion. These institutions are dedicated to serving low-income communities by providing affordable and accessible financial services. Through initiatives like microloans and community development programs, CDFIs contribute to empowering individuals and businesses often overlooked by traditional financial institutions.

Digital Financial Services: A Catalyst for Inclusion

The rise of digital financial services has been a game-changer in fostering financial inclusion. Mobile banking, online payments, and digital wallets offer convenient and cost-effective solutions, particularly for those without easy access to physical banking locations. The widespread adoption of smartphones has further accelerated the reach of digital financial services.

Government Initiatives and Policies

Government initiatives and policies play a crucial role in advancing financial inclusion. Programs such as the Community Reinvestment Act (CRA) encourage financial institutions to meet the needs of all members of the communities they serve. Additionally, regulatory efforts aim to create an environment that fosters responsible and inclusive financial practices.

Financial Education and Literacy Programs

Promoting financial education is fundamental to overcoming barriers to inclusion. Financial literacy programs empower individuals to make informed decisions about their money, understand the importance of savings, and navigate the financial landscape. These programs contribute to building a financially savvy population.

Microfinance and Small Business Support

Microfinance institutions provide financial services to individuals in low-income brackets, often enabling entrepreneurship and small business development. By offering microloans and financial training, these institutions contribute to economic empowerment, creating a ripple effect within communities.

Collaboration between Public and Private Sectors

Effective financial inclusion requires collaboration between the public and private sectors. Public-private partnerships can leverage the strengths of both sectors to create innovative solutions that address the diverse needs of individuals and businesses. Collaborative efforts enhance the impact of financial inclusion initiatives.

Measuring Impact and Progress

Measuring the impact of financial inclusion initiatives is crucial for refining strategies and ensuring effectiveness. Metrics such as increased banking access, higher savings rates, and improved credit scores provide valuable insights into the progress of inclusion efforts. Regular assessments guide policymakers and stakeholders in making informed decisions.

Exploring Opportunities with Financial Inclusion USA

To explore the ongoing initiatives and opportunities related to Financial Inclusion in the USA, visit www.cleverscale.com. Discover how financial inclusion is not just a goal but a transformative force driving economic equity and empowerment. Embracing inclusivity in the financial sector is a collective journey toward a more prosperous and just society.