Unlocking Potential: Navigating USA Financial Stocks

Embarking on the journey of investing in financial stocks demands a deep understanding of the dynamics that drive the financial sector in the USA. In this article, we explore the intricacies of USA Financial Stocks, offering insights, strategies, and considerations for investors looking to navigate this critical segment of the market.

The Foundation: Understanding USA Financial Stocks

USA Financial Stocks constitute a significant portion of the broader stock market. To make informed investment decisions, it’s essential to understand the nature of financial stocks, encompassing banks, insurance companies, investment firms, and other financial institutions. A solid grasp of this foundation is crucial for investors seeking exposure to the financial sector.

Market Forces: Influencing Financial Stocks

The performance of USA Financial Stocks is intricately tied to various market forces. Economic conditions, interest rates, and regulatory changes play pivotal roles in shaping the landscape of financial stocks. Investors should stay attuned to these market forces to anticipate potential impacts on financial stocks and adjust their strategies accordingly.

Economic Indicators: Navigating Financial Stocks Terrain

Economic indicators hold particular significance when navigating USA Financial Stocks. Metrics such as GDP growth, inflation rates, and unemployment figures directly impact the financial sector. Investors relying on these indicators gain valuable insights into the broader economic environment, allowing for more informed decisions regarding financial stocks.

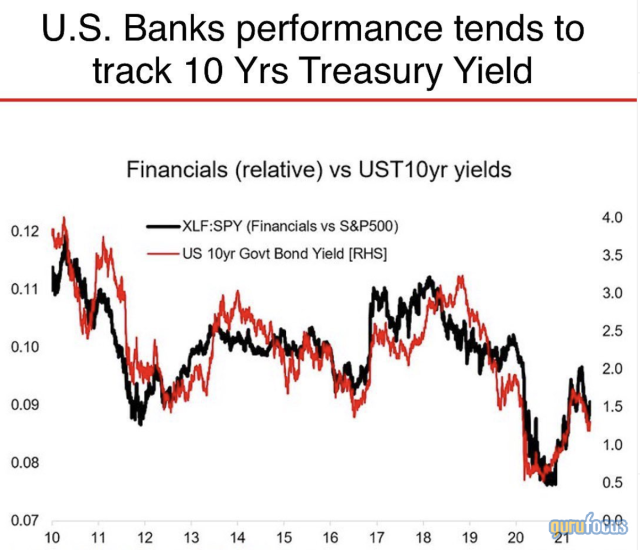

Interest Rates and Financial Stocks: A Symbiotic Relationship

Interest rates wield considerable influence over USA Financial Stocks. The financial sector often reacts to changes in interest rates, impacting borrowing costs, profitability, and investment decisions. Understanding the dynamics of this symbiotic relationship is crucial for investors aiming to navigate the nuances of financial stocks successfully.

Regulatory Landscape: Shaping Financial Stocks Performance

The regulatory environment significantly shapes the performance of USA Financial Stocks. Changes in financial regulations, government policies, and compliance requirements can have profound effects on financial institutions. Investors must stay abreast of the regulatory landscape to assess potential risks and opportunities within the financial sector.

Risk and Reward: Balancing Strategies in Financial Stocks

Investing in USA Financial Stocks involves navigating a balance between risk and reward. Financial stocks can be volatile, and the potential for both gains and losses is substantial. Implementing effective risk management strategies, such as diversification and thorough research, is paramount for investors seeking sustainable success in the financial sector.

Technology Disruption: Impact on Financial Stocks

The financial industry is undergoing a technological revolution, and this disruption significantly influences USA Financial Stocks. Fintech innovations, digital transformation, and the rise of online banking reshape the competitive landscape. Investors exploring financial stocks must consider the implications of technology-driven changes for long-term investment strategies.

Diversification Strategies: Optimizing Financial Stocks Portfolios

Diversification is a fundamental strategy for optimizing portfolios that include USA Financial Stocks. Spreading investments across different financial subsectors, such as banking, insurance, and fintech, helps mitigate risks associated with the performance of any single sector. Diversification enhances the resilience of a financial stock portfolio in varying market conditions.

Long-Term Success: Investing Wisely in Financial Stocks

While short-term market fluctuations are inevitable, the focus on long-term success is crucial for investors in USA Financial Stocks. Identifying financially sound institutions, staying informed about market trends, and maintaining a disciplined approach to investing contribute to sustained success over the years.

Conclusion: Navigating Financial Stocks with Confidence

In conclusion, navigating the terrain of USA Financial Stocks requires a blend of understanding market dynamics, monitoring economic indicators, and adapting to regulatory changes. Investors seeking to unlock the potential of financial stocks should explore the possibilities offered by USA Financial Stocks on CleverScale. Empower your investment journey with comprehensive insights and make informed decisions in the dynamic and critical financial sector.