Decoding Credit Scores in the USA: A Roadmap to Financial Health

Understanding the Importance of Credit Scores

In the intricate web of personal finance, credit scores in the USA play a crucial role in determining an individual’s financial health. This article serves as a comprehensive guide, unraveling the intricacies of credit scores and their impact on various aspects of financial life.

What is a Credit Score?

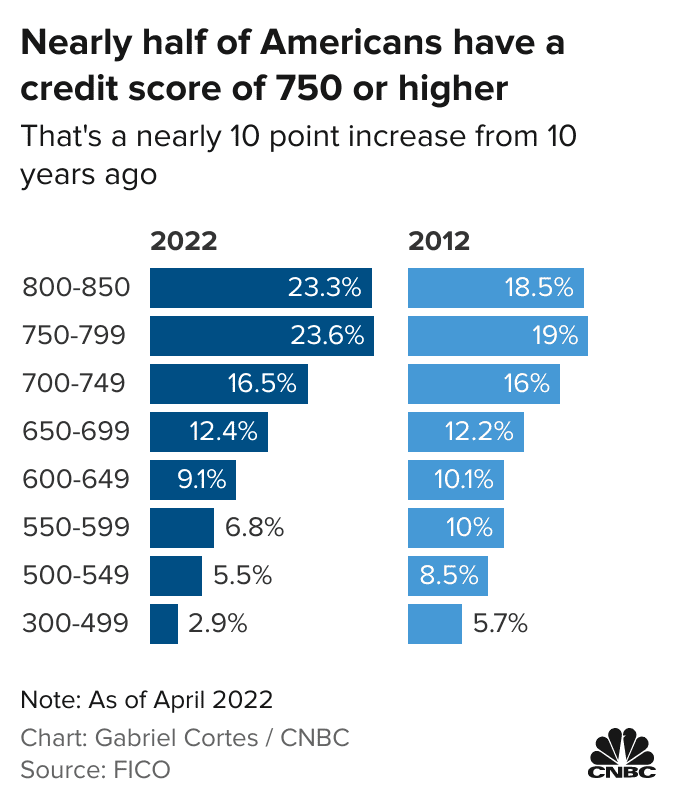

A credit score is a numerical representation of an individual’s creditworthiness. Ranging from 300 to 850, higher scores indicate better creditworthiness, making it easier to qualify for loans, credit cards, and favorable interest rates. Credit scores are generated based on various financial behaviors and credit history.

Factors Influencing Credit Scores

Several factors contribute to the calculation of credit scores. Payment history, credit utilization, length of credit history, types of credit in use, and new credit accounts all play a role. Understanding how these factors impact credit scores is key to managing and improving one’s financial standing.

The Impact of Payment History

Payment history is a significant factor in credit score calculation. Timely payments on credit accounts, loans, and bills contribute positively to the credit score, while late payments, defaults, and bankruptcies can have adverse effects. Maintaining a consistent record of on-time payments is crucial for a healthy credit score.

Managing Credit Utilization

Credit utilization refers to the ratio of credit used to the total credit available. Keeping credit card balances low relative to the credit limit positively influences credit scores. High credit utilization may signal financial stress and impact creditworthiness negatively.

Building and Maintaining Credit History

The length of credit history is another determinant of credit scores. Establishing a positive credit history over time by responsibly managing credit accounts contributes to higher credit scores. Consistency and responsible credit use are key factors in building and maintaining a robust credit history.

Diversification of Credit Types

The types of credit used also impact credit scores. A diverse mix of credit types, such as credit cards, installment loans, and retail accounts, can positively influence credit scores. It demonstrates an ability to manage different forms of credit responsibly.

The Role of New Credit Accounts

Opening multiple new credit accounts within a short period can be perceived as a risk factor, potentially lowering credit scores. Responsible management of new credit accounts is crucial to avoid negative impacts on creditworthiness.

Monitoring and Improving Credit Scores

Regularly monitoring credit scores is essential for financial awareness. Individuals can obtain free annual credit reports to review their credit history. If discrepancies or inaccuracies are found, they should be addressed promptly. Additionally, adopting healthy financial habits can contribute to improving credit scores over time.

CleverScale: Navigating Credit Scores in the USA

For a deeper understanding of credit scores in the USA, visit Credit Scores USA. CleverScale provides valuable insights, tools, and resources to empower individuals in managing and improving their credit scores. Explore the platform for comprehensive guidance on navigating the world of credit.

Conclusion: Empowering Financial Futures

In conclusion, credit scores in the USA serve as financial barometers, influencing access to credit and shaping financial opportunities. Understanding the factors affecting credit scores and adopting responsible financial habits are crucial steps toward achieving and maintaining a healthy credit profile. Explore the insights provided by CleverScale to empower your financial future through informed credit management.