Understanding the Landscape of USA Insurance Policies

Insurance is a crucial aspect of financial planning in the United States, providing individuals and businesses with protection against various risks. Navigating the diverse landscape of USA insurance policies is essential for securing comprehensive coverage that aligns with specific needs and circumstances.

Auto Insurance: Safeguarding Vehicles and Drivers

Auto insurance is a legal requirement in many states, designed to protect drivers and their vehicles. Policies can include coverage for liability, collision, comprehensive, and uninsured/underinsured motorist protection. Understanding the nuances of auto insurance is vital for ensuring adequate coverage in case of accidents or unforeseen events.

Homeowners Insurance: Protecting Homes and Belongings

Homeowners insurance provides coverage for damages to a home and its contents. This includes protection against natural disasters, theft, and liability for injuries that may occur on the property. Homeowners should carefully assess their insurance needs, considering factors such as location, property value, and personal belongings.

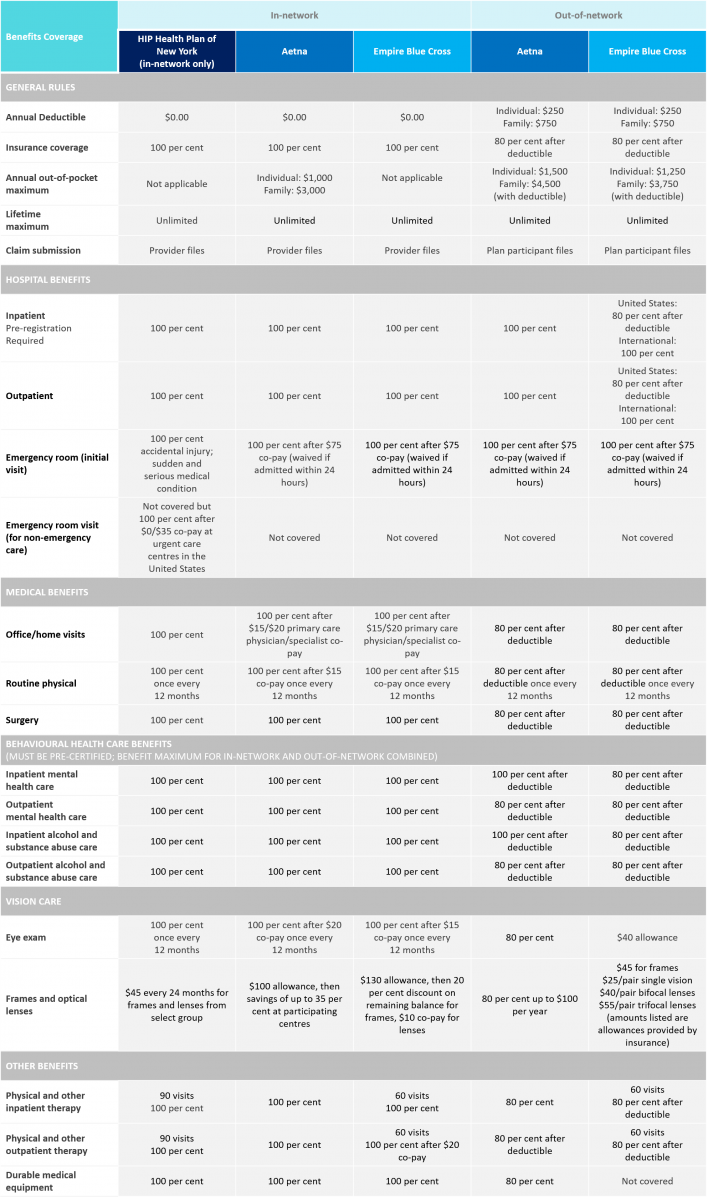

Health Insurance: Ensuring Access to Medical Care

Health insurance is crucial for covering medical expenses and ensuring access to quality healthcare. With various plans available, individuals and families can choose coverage that meets their healthcare needs. Understanding the terms, coverage limits, and out-of-pocket costs is essential when selecting a health insurance policy.

Life Insurance: Providing Financial Security for Loved Ones

Life insurance plays a vital role in providing financial security for loved ones in the event of a policyholder’s death. Term life and whole life insurance are common options, each offering unique benefits. Evaluating personal financial goals and family needs is crucial when determining the appropriate life insurance coverage.

Business Insurance: Mitigating Risks for Businesses

For businesses, insurance is a critical risk management tool. Business insurance policies can include coverage for property damage, liability, employee injuries, and more. Understanding the specific risks associated with a business is essential for tailoring insurance coverage to mitigate potential financial losses.

Renters Insurance: Protecting Tenant Possessions

Renters insurance is designed to protect the personal belongings of those who rent their living space. This type of insurance provides coverage for items such as electronics, furniture, and clothing in case of theft, fire, or other covered events. Renters should carefully review policy terms and coverage limits.

Umbrella Insurance: Additional Liability Protection

Umbrella insurance provides an extra layer of liability protection beyond the coverage limits of other insurance policies. It is particularly valuable in scenarios where a policyholder may face significant legal claims or lawsuits. Understanding the circumstances under which umbrella insurance comes into play is essential for comprehensive coverage.

Travel Insurance: Securing Peace of Mind Abroad

Travel insurance is crucial for individuals embarking on domestic or international trips. Policies can include coverage for trip cancellations, medical emergencies, and lost luggage. Travelers should carefully review policy details to ensure they have the necessary coverage for their specific travel plans.

Pet Insurance: Caring for Furry Family Members

As pets become integral members of many families, pet insurance has gained popularity. This type of insurance covers veterinary expenses, ensuring that pets receive necessary medical care. Pet owners should explore different policies to find coverage that suits their pets’ specific healthcare needs.

Flood Insurance: Addressing Specific Environmental Risks

Flood insurance is often a separate policy that covers damages caused by flooding, a peril not typically included in standard homeowners insurance. Individuals residing in flood-prone areas should consider the importance of this specialized coverage to protect their homes and belongings.

In conclusion, navigating the diverse realm of USA insurance policies requires a thorough understanding of individual and business needs. From auto and homeowners insurance to specialized coverage like pet and flood insurance, making informed decisions ensures comprehensive protection against unforeseen events. To explore more about USA Insurance Policies and find the coverage that suits your needs, visit www.cleverscale.com.