Exploring the Potential of USA Growth Stocks

Investors seeking maximum returns often turn to the dynamic world of USA growth stocks. Navigating this landscape requires a keen understanding of growth investing principles, market trends, and the potential for long-term prosperity.

Defining USA Growth Stocks

Growth stocks are shares in companies with the potential for above-average earnings growth. In the USA, these stocks often belong to innovative industries, promising startups, or companies demonstrating exceptional expansion. Identifying these opportunities early on can lead to significant returns.

The Allure of High Returns

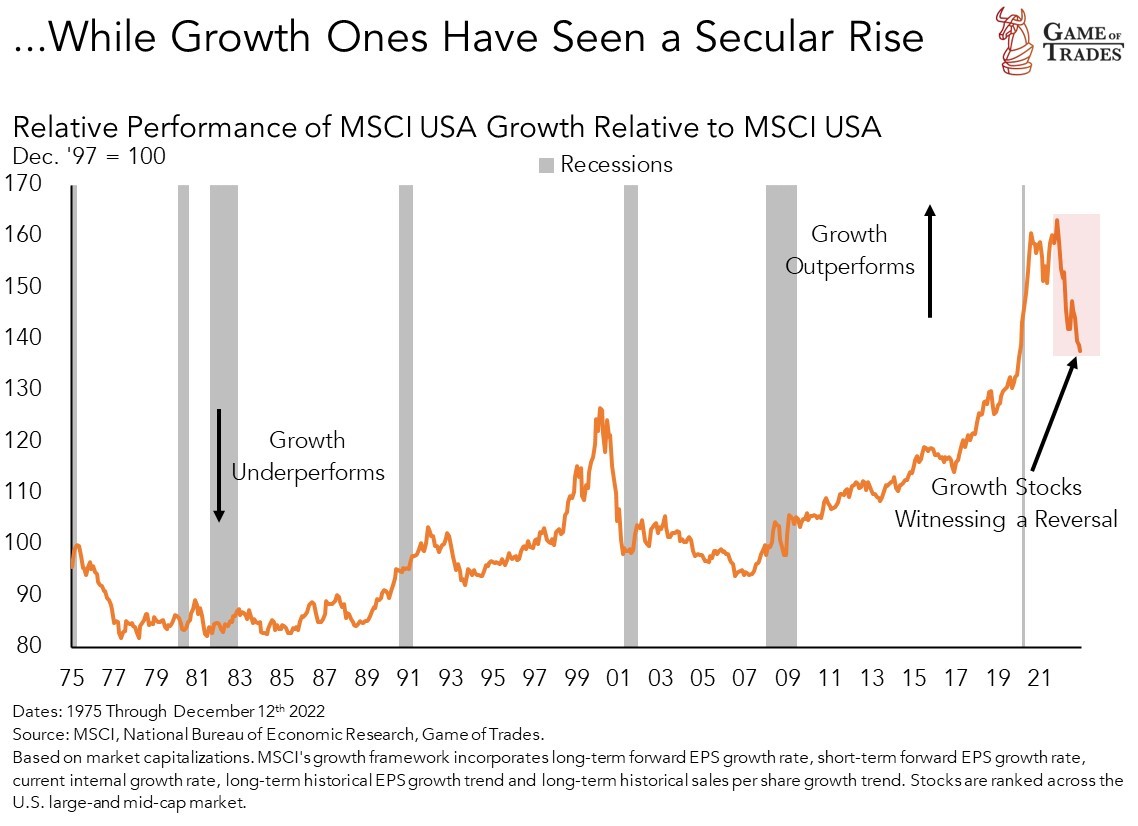

One of the primary attractions of USA growth stocks is the potential for high returns. These stocks often outpace the broader market, driven by factors such as technological advancements, market disruption, and strong consumer demand. Investors are drawn to the prospect of capitalizing on these growth trajectories.

Understanding the Risks

While the potential for high returns is enticing, it’s crucial to acknowledge the risks associated with growth stocks. These investments can be more volatile than their value counterparts, and market sentiment can significantly influence their performance. Investors should be prepared for fluctuations and conduct thorough research.

Investing in Innovative Industries

Growth stocks in the USA are frequently found in innovative and disruptive industries such as technology, biotech, and renewable energy. Investing in companies at the forefront of these sectors provides an opportunity to be part of groundbreaking advancements and benefit from their growth.

Research and Due Diligence

Successful investing in USA growth stocks hinges on thorough research and due diligence. Investors should analyze a company’s financial health, competitive positioning, and growth prospects. Staying informed about industry trends and potential disruptors is essential for making informed investment decisions.

Long-Term Vision for Prosperity

A key principle of growth investing is having a long-term vision. While short-term market fluctuations may occur, the focus is on the company’s trajectory over several years. This perspective allows investors to weather market volatility and capture the full potential of a company’s growth.

Diversification for Risk Management

Diversification remains a fundamental strategy in investing, even when focusing on growth stocks. Spreading investments across different sectors and industries helps manage risk. While growth stocks offer high potential returns, having a diversified portfolio provides stability amid market uncertainties.

Monitoring Market Trends

Staying attuned to market trends is crucial for navigating the landscape of USA growth stocks. Industry shifts, technological advancements, and changes in consumer behavior can significantly impact the growth potential of companies. Regular monitoring allows investors to adapt their strategies accordingly.

Accessing Resources for Informed Decisions

For investors navigating the realm of USA growth stocks, access to resources is vital. Platforms like USA Growth Stocks offer valuable insights, market analyses, and tools to enhance investors’ understanding and support informed decision-making.

Conclusion: Unlocking Prosperity with USA Growth Stocks

In conclusion, USA growth stocks present a compelling opportunity for investors seeking maximum returns. By understanding the dynamics of growth investing, conducting thorough research, and staying informed, investors can position themselves to unlock the full potential of these dynamic assets. Explore more insights and opportunities at USA Growth Stocks to elevate your growth investing strategy.