Deciphering Trends: A Deep Dive into USA Stock Prices

Understanding the intricate dynamics of Stock Prices in the USA is crucial for investors seeking to navigate the financial markets successfully. In this article, we delve into the trends, analysis, and strategic considerations that surround USA Stock Prices, shedding light on how investors can make informed decisions to optimize their portfolios.

Grasping the Dynamics of USA Stock Prices

USA Stock Prices are influenced by a myriad of factors, including market demand, economic indicators, and company performance. Analyzing the dynamics of stock prices involves a comprehensive examination of these factors, providing investors with insights into potential opportunities and risks.

Economic Indicators and Their Impact on Stock Prices

Economic indicators play a pivotal role in shaping the trajectory of USA Stock Prices. Metrics such as GDP growth, unemployment rates, and inflation can significantly influence investor sentiment and market trends. Monitoring these indicators allows investors to anticipate potential movements in stock prices and adjust their strategies accordingly.

Company Performance and Stock Valuation

An integral component of analyzing USA Stock Prices is evaluating the performance of individual companies. Factors such as earnings reports, revenue growth, and market share contribute to stock valuation. Investors keen on making informed decisions should delve into the financial health and outlook of companies to gauge their potential for future stock price appreciation.

Market Trends and Their Impact

Trends in the overall market also exert a considerable impact on USA Stock Prices. Bullish trends, characterized by rising prices, often coincide with periods of economic growth, while bearish trends, marked by declining prices, may be indicative of economic challenges. Recognizing and understanding market trends is fundamental for effective investment decision-making.

Global Influences on Stock Prices

In an interconnected global economy, international events and geopolitical factors can sway USA Stock Prices. Trade agreements, political developments, and economic shifts abroad can create ripple effects in the domestic market. Investors must consider these global influences to comprehensively analyze and anticipate stock price movements.

Risk Management Strategies in Stock Investing

Navigating the fluctuations in USA Stock Prices requires a robust risk management strategy. Investors should implement techniques such as diversification, setting stop-loss orders, and staying informed about potential market risks. A disciplined approach to risk management is crucial for safeguarding investments during periods of price volatility.

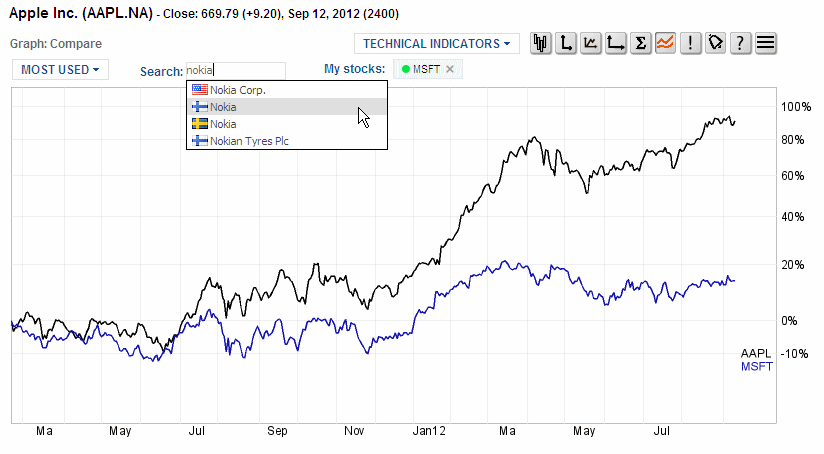

Leveraging Technology for Real-Time Analysis

Technology has revolutionized the way investors analyze USA Stock Prices. Platforms like CleverScale provide real-time data, advanced analytics, and tools that empower investors to conduct thorough analyses efficiently. Explore Stock Prices USA on CleverScale for a comprehensive experience in leveraging technology for stock market analysis.

Short-Term vs. Long-Term Strategies

Investors often grapple with the decision to adopt short-term or long-term investment strategies based on USA Stock Prices. Short-term traders capitalize on price fluctuations for quick gains, while long-term investors focus on the fundamentals of companies and their growth potential. The choice between these strategies depends on individual risk tolerance and investment objectives.

The Role of Sentiment Analysis in Stock Prices

Beyond traditional metrics, sentiment analysis has gained prominence in assessing USA Stock Prices. Social media, news sentiment, and market sentiment indicators offer additional layers of information for investors. Incorporating sentiment analysis into the evaluation process provides a more holistic view of market dynamics.

Conclusion: Informed Decision-Making for Optimal Returns

In conclusion, USA Stock Prices are a reflection of a complex interplay of economic, company-specific, and global factors. Successful investors navigate this complexity by staying informed, leveraging technology, and implementing sound risk management strategies. Explore the insights offered by Stock Prices USA on CleverScale to enhance your analytical capabilities and make informed decisions for optimal returns.