Optimizing USA Market Performance for Strategic Growth

Investors aiming for success in the dynamic landscape of the USA market must focus on optimizing performance through strategic and informed approaches.

Understanding the Dynamics of USA Market Performance

Before delving into strategies, it’s essential to grasp the dynamics that influence USA market performance. Factors such as economic indicators, global events, and sector-specific trends contribute to the market’s overall health. A comprehensive understanding of these dynamics forms the foundation for strategic decision-making.

Economic Indicators as Performance Barometers

Economic indicators serve as barometers for USA market performance. Metrics like GDP growth, employment rates, and inflation rates provide insights into the economic health of the country. Investors keen on optimizing performance monitor these indicators closely, as they can signal potential shifts in the market.

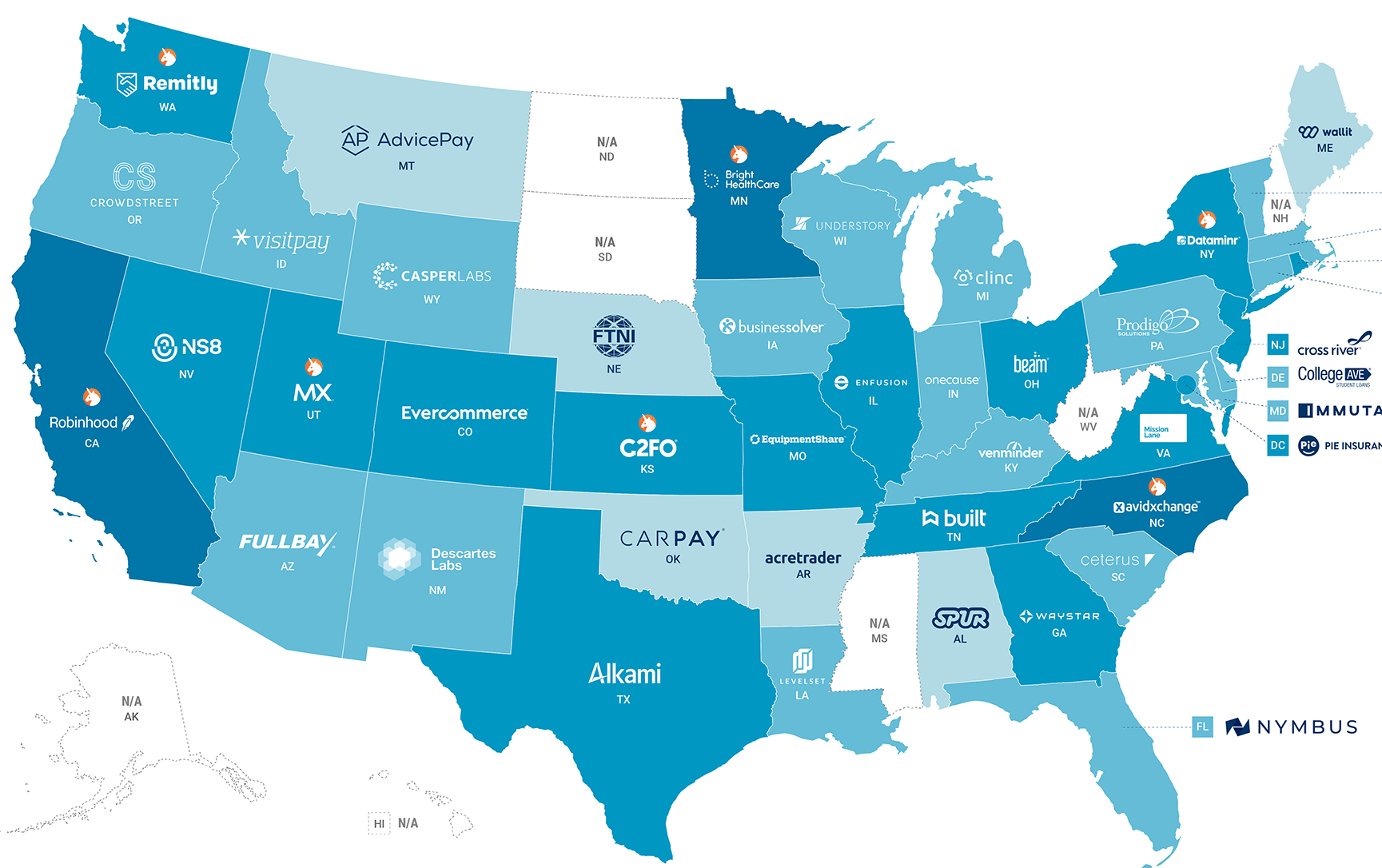

Sector Analysis for Targeted Growth Opportunities

A nuanced approach to USA market performance involves sector analysis. Different sectors exhibit varying growth patterns and levels of resilience. Investors strategically allocate their resources by identifying sectors with growth potential and favorable market conditions. This targeted approach contributes to optimizing overall portfolio performance.

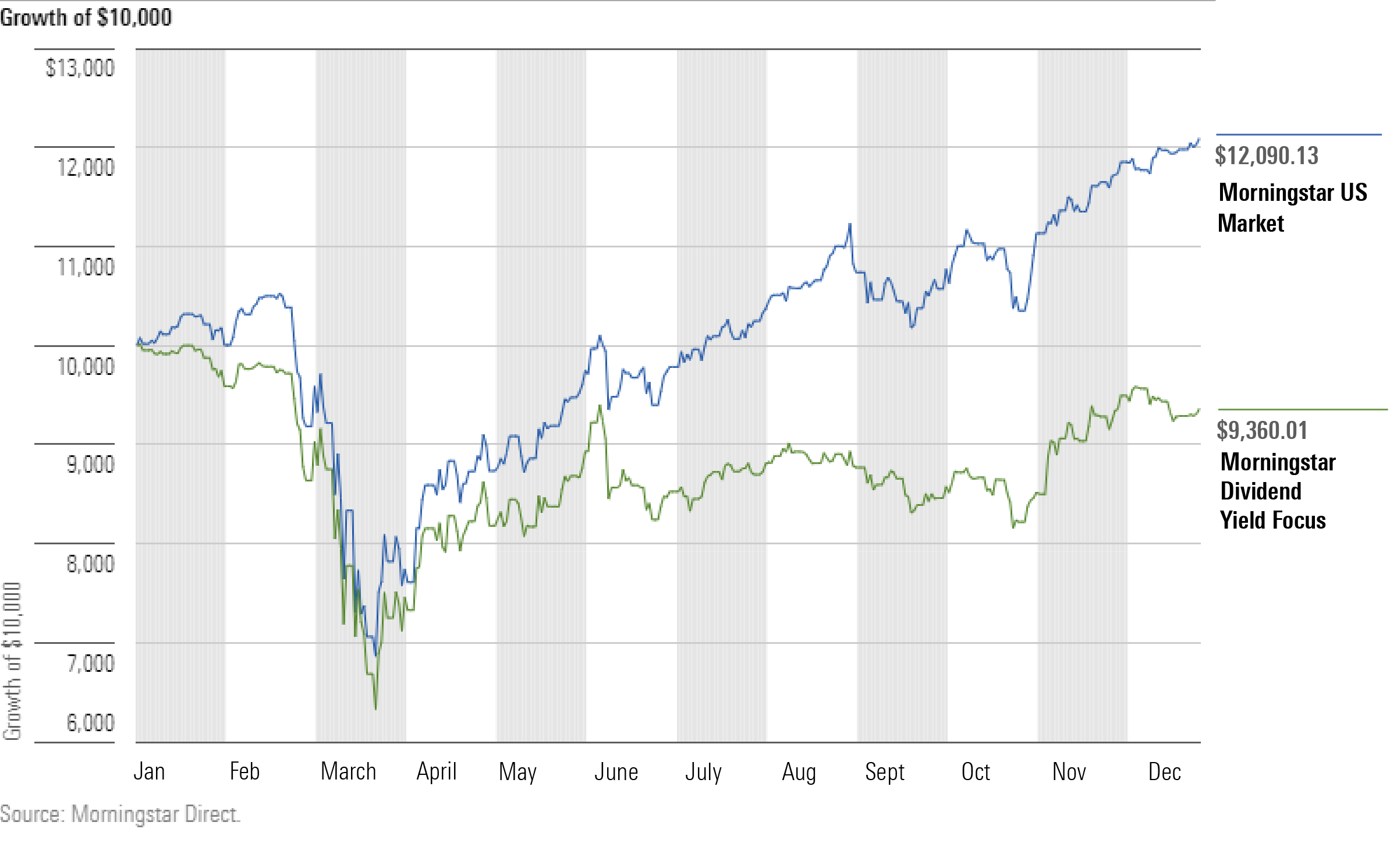

Global Events and Market Adaptability

Global events exert a significant impact on USA market performance. Geopolitical developments, trade agreements, and unforeseen global crises can introduce volatility. Successful investors remain adaptable, adjusting their strategies in response to these events to optimize performance amid changing market conditions.

Technological Integration for Enhanced Performance

In the digital age, technological integration is a key driver of market performance. Investors leverage advanced tools, data analytics, and algorithmic trading to gain a competitive edge. The strategic use of technology enhances decision-making processes, contributing to optimized performance in the fast-paced USA market.

Risk Management Strategies for Performance Safeguarding

Effective risk management is integral to optimizing USA market performance. Investors implement strategies such as diversification, setting stop-loss orders, and thorough due diligence to mitigate potential risks. Safeguarding against downside risks is essential for maintaining consistent and sustainable performance over the long term.

Long-Term vs. Short-Term Performance Objectives

Investors often grapple with the decision between long-term and short-term performance objectives. Long-term investors focus on steady growth and the compounding effect over time. In contrast, short-term investors aim to capitalize on immediate market movements. Aligning performance objectives with one’s investment horizon is crucial for strategic decision-making.

Environmental, Social, and Governance (ESG) Factors

Considering environmental, social, and governance (ESG) factors has become integral to optimizing USA market performance. Investors increasingly recognize the importance of sustainable and ethical practices in companies. Aligning investments with ESG principles not only contributes to positive societal impact but also positions portfolios for long-term performance.

Professional Guidance for Performance Excellence

Navigating the complexities of the USA market is a daunting task, and seeking professional guidance can be invaluable. Experienced financial advisors provide personalized strategies, market insights, and recommendations tailored to individual financial goals. Collaborating with professionals enhances the likelihood of optimizing market performance.

Conclusion: Strategizing for Continuous Growth

In conclusion, optimizing USA market performance requires a strategic and adaptive approach. Understanding economic indicators, analyzing sectors, leveraging technology, and integrating risk management strategies contribute to sustained growth. Explore additional insights and resources on USA Market Performance to refine your strategies and navigate the ever-evolving landscape of the USA market.