Strategic Stock Portfolios: Navigating the USA Market

Building and managing a stock portfolio in the USA market requires strategic thinking and a nuanced approach. This article delves into key considerations and tactics for creating a successful stock portfolio tailored to the dynamics of the USA market.

Understanding the USA Stock Market Landscape

Before embarking on crafting a stock portfolio, it’s crucial to have a comprehensive understanding of the USA stock market. Different exchanges, market sectors, and industry trends contribute to the market’s complexity. Knowing the landscape lays the foundation for strategic decision-making in portfolio construction.

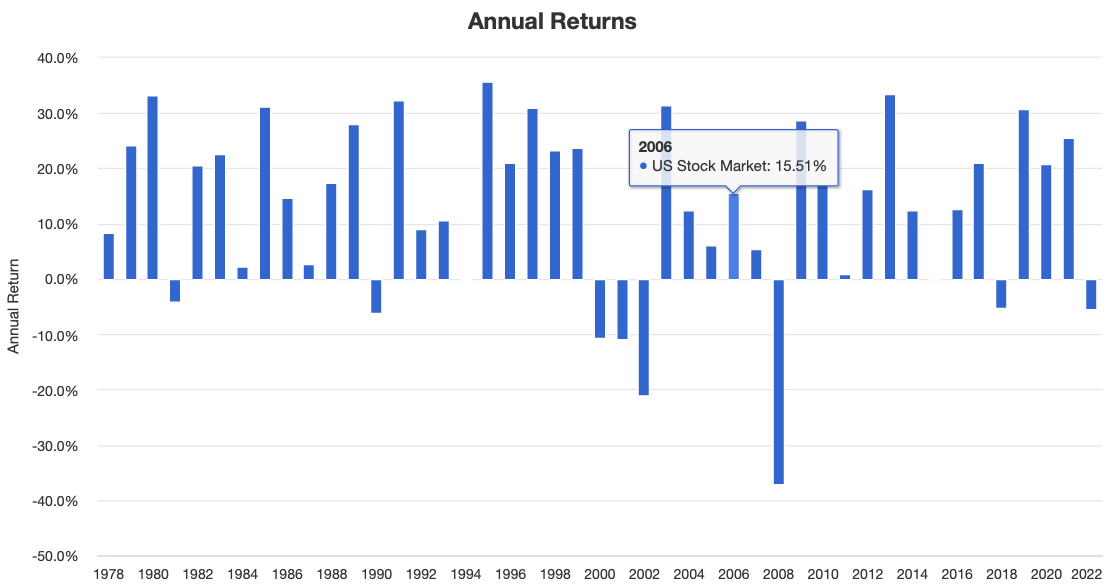

Diversification: The Cornerstone of Resilient Portfolios

Diversification is a fundamental strategy for creating resilient stock portfolios in the USA. Spreading investments across different sectors and industries helps mitigate risks associated with market volatility. A well-diversified portfolio is better positioned to weather fluctuations and potential downturns in specific sectors.

Strategic Asset Allocation for Optimal Returns

Strategic asset allocation is a key component of successful stock portfolios. Balancing investments across various asset classes, such as stocks, bonds, and potentially other alternatives, helps optimize returns while managing risk. Investors must tailor their asset allocation to align with their financial goals, risk tolerance, and market conditions.

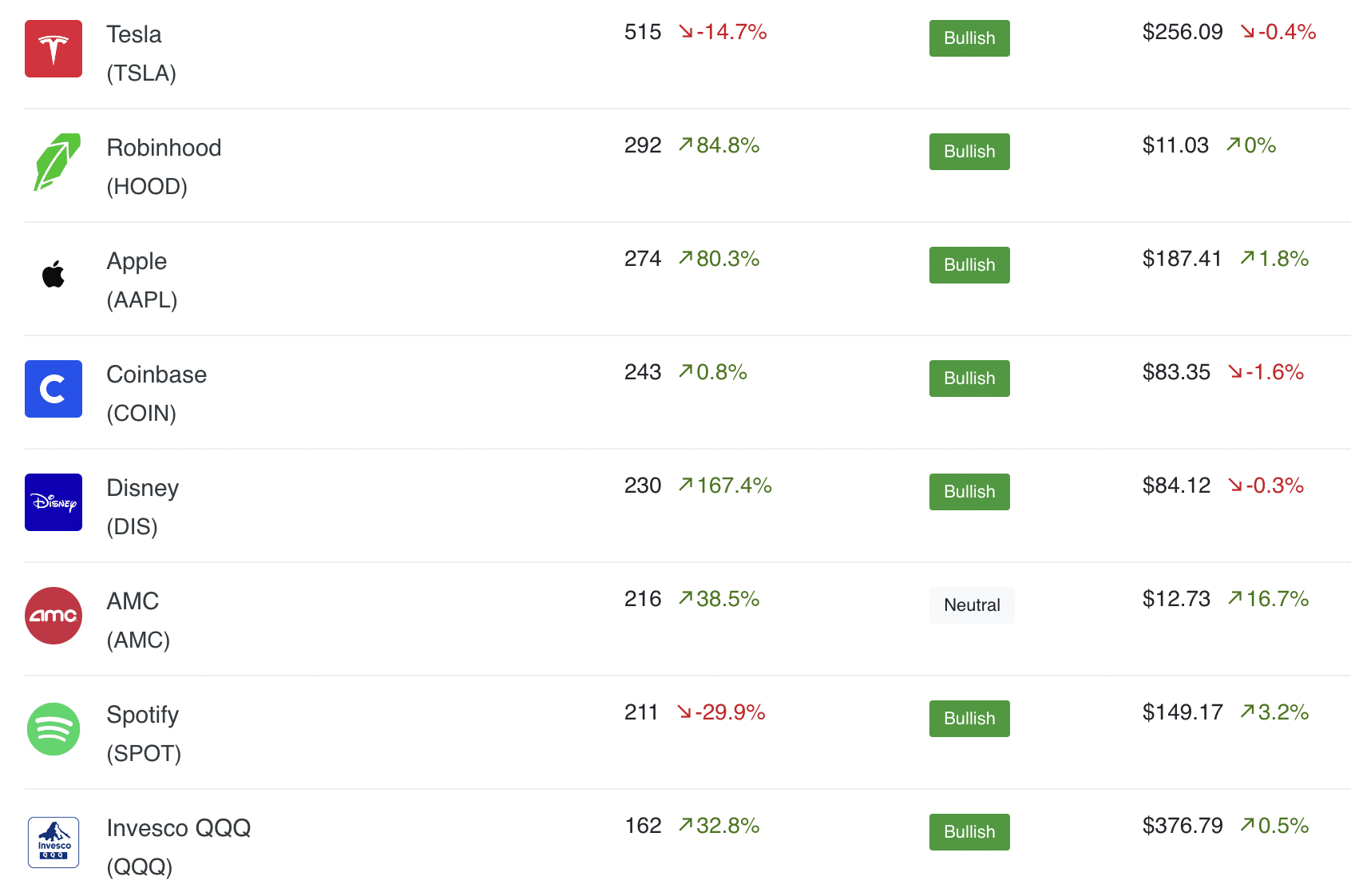

Evaluating Individual Stock Selections

The heart of any stock portfolio lies in individual stock selections. Conducting thorough research, utilizing fundamental analysis, and assessing a company’s financial health contribute to making informed choices. Investors need to scrutinize factors such as earnings reports, growth potential, and competitive positioning when selecting stocks for their portfolios.

Long-Term vs. Short-Term Investing Strategies

Determining the investment horizon is a critical decision in stock portfolio construction. Long-term investors focus on holding stocks over an extended period, aiming for capital appreciation. In contrast, short-term investors capitalize on market fluctuations for quicker returns. Aligning the investment strategy with individual goals is essential for portfolio success.

Monitoring and Rebalancing for Portfolio Optimization

A successful stock portfolio requires continuous monitoring and occasional rebalancing. Regularly assessing the performance of individual holdings, market trends, and changes in economic conditions informs the need for adjustments. Rebalancing ensures that the portfolio stays aligned with the investor’s objectives and market dynamics.

Utilizing Technology for Portfolio Management

In the digital age, technology plays a pivotal role in managing stock portfolios. Online platforms and investment apps provide real-time data, portfolio tracking, and analysis tools. Embracing technology empowers investors to make informed decisions, execute trades efficiently, and stay agile in responding to market changes.

Expert Insights for Informed Decision-Making

For investors seeking expert guidance tailored to the USA market, platforms like Stock Portfolio USA offer valuable insights and analysis. Accessing these resources provides investors with expert perspectives to inform their decision-making and optimize their stock portfolios.

Risk Management and Mitigation Strategies

Effective risk management is essential for preserving and growing a stock portfolio. Investors must assess their risk tolerance, set clear risk management rules, and implement strategies such as stop-loss orders. Understanding and mitigating risks contribute to the overall resilience of the portfolio.

Continuous Learning and Adaptability in Investing

The landscape of the USA stock market is dynamic, and successful investors engage in continuous learning. Staying informed about market trends, economic developments, and emerging investment opportunities ensures that investors can adapt their strategies to evolving conditions and make informed decisions.

Conclusion: Crafting a Robust Stock Portfolio

Crafting a robust stock portfolio in the USA involves a combination of strategic thinking, diversification, thorough research, and continuous learning. By incorporating these considerations and leveraging resources like Stock Portfolio USA, investors can navigate the complexities of the market and build portfolios poised for long-term success.