Unlocking Financial Success: Strategic Stock Investment in the USA

Embarking on a journey of stock investment in the USA requires a strategic approach and a nuanced understanding of the market dynamics. This article explores key elements that contribute to successful stock investment and provides insights for investors aiming to achieve financial success in the diverse and dynamic US market.

Understanding the Basics of Stock Investment

Before delving into the intricacies of stock investment, it’s crucial to grasp the basics. Stock investment involves buying shares of publicly traded companies with the expectation of capital appreciation and potential dividends. Investors should understand market orders, limit orders, and other fundamental concepts to navigate the stock market effectively.

Developing a Strategic Investment Plan

A strategic investment plan is the foundation of successful stock investment. This plan should align with an investor’s financial goals, risk tolerance, and time horizon. Whether pursuing long-term growth, income, or a balanced approach, a well-defined investment plan guides decision-making and helps investors stay focused amid market fluctuations.

Diversification for Risk Management

Diversification is a key principle in stock investment. Spreading investments across different sectors, industries, and asset classes helps mitigate risk. By avoiding overconcentration in a particular stock or sector, investors can protect their portfolios from the impact of adverse events affecting a specific industry.

Evaluating Fundamental Analysis

Fundamental analysis is a critical tool for stock investors. It involves assessing a company’s financial health, earnings potential, and overall business model. Investors scrutinize financial statements, earnings reports, and economic indicators to make informed decisions about the intrinsic value of a stock.

Utilizing Technical Analysis for Timing

Technical analysis complements fundamental analysis by focusing on historical price data and market trends. Investors use charts, indicators, and patterns to identify potential entry and exit points. Technical analysis aids in timing stock investments and navigating short-term price movements driven by market sentiment.

Staying Informed with Market News

The stock market is influenced by a myriad of factors, including economic indicators, corporate earnings, and global events. Staying informed about market news is crucial for anticipating market movements and making timely investment decisions. Regularly monitoring financial news sources provides valuable insights into the factors shaping the market.

Long-Term Investing vs. Short-Term Trading

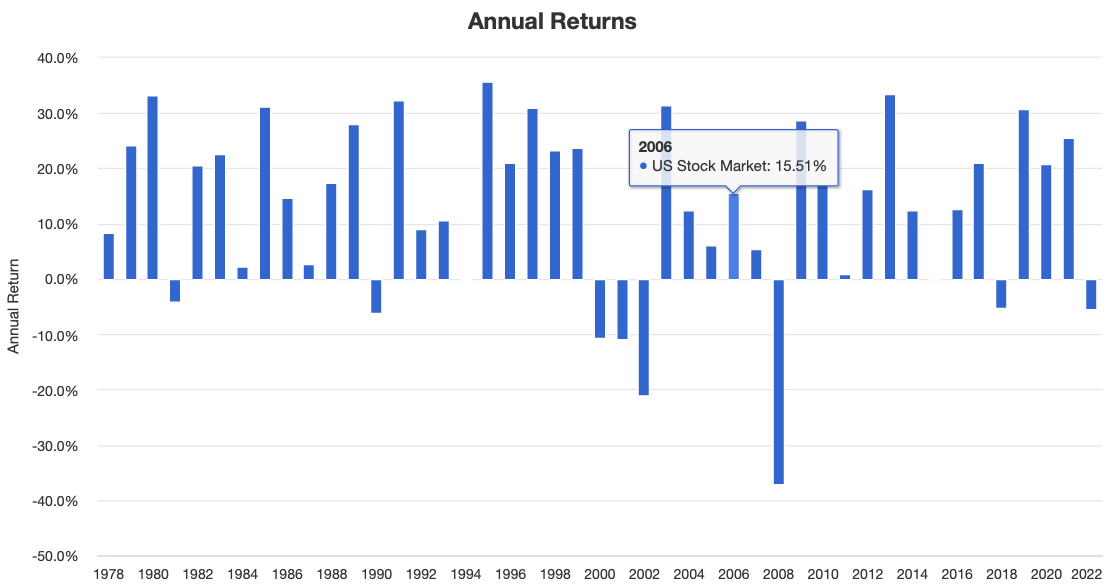

Investors should determine their investment horizon, whether they are focused on long-term growth or engaging in short-term trading. Long-term investors benefit from the compounding effect and may weather short-term market volatility more comfortably. In contrast, short-term traders seek to capitalize on price fluctuations for quick gains.

Choosing the Right Investment Vehicles

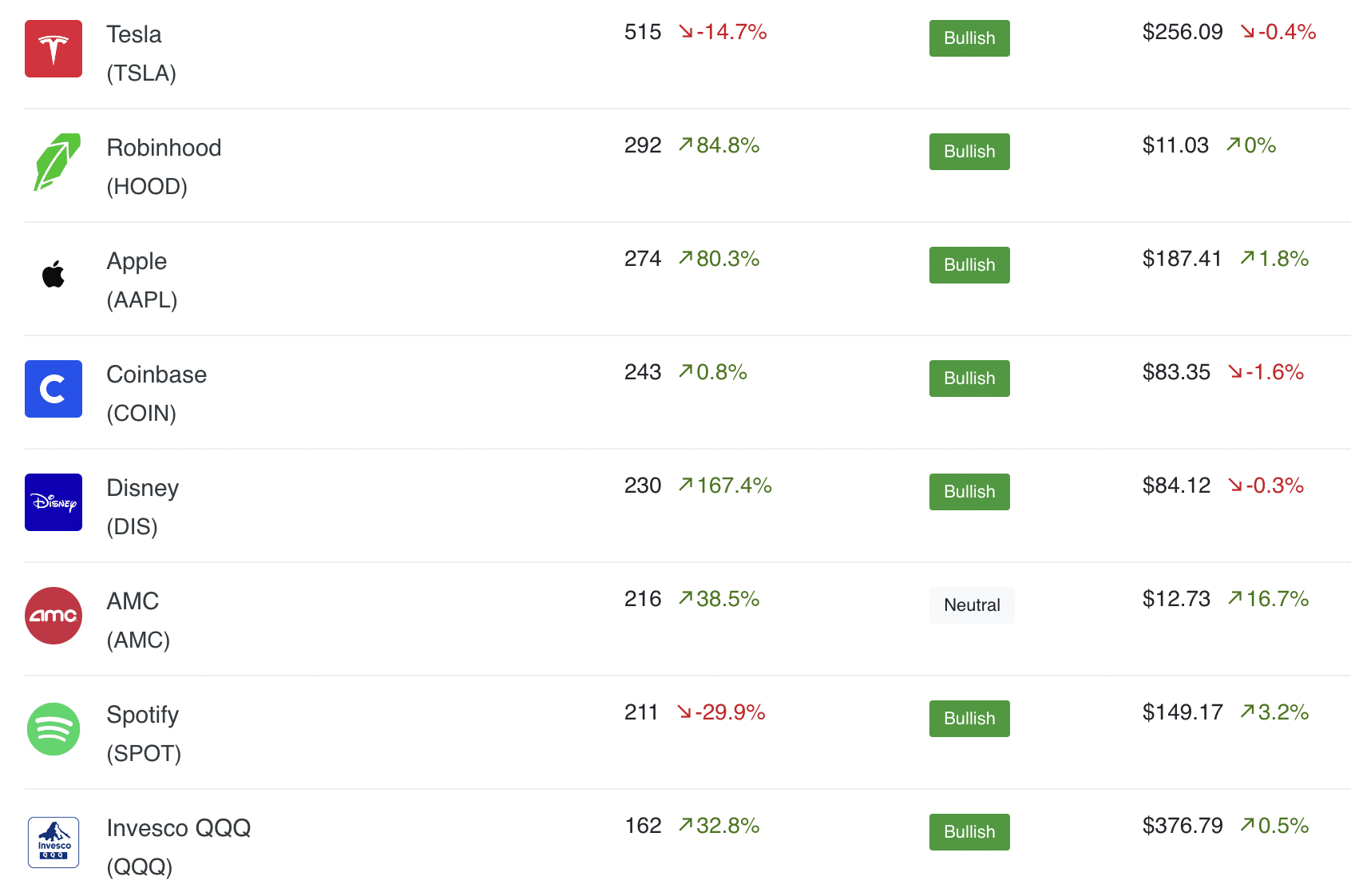

Stock investment offers various avenues, including individual stocks, exchange-traded funds (ETFs), and mutual funds. Each investment vehicle has its advantages and considerations. Investors should choose vehicles that align with their investment goals, risk tolerance, and preferences for active or passive management.

Navigating Market Volatility

The stock market is inherently volatile, and investors must navigate periods of market ups and downs. Having a resilient investment strategy, maintaining a long-term perspective, and avoiding impulsive decisions during market fluctuations contribute to successful navigation of market volatility.

Accessing Resources at Stock Investment USA

For investors seeking insights, analysis, and resources for successful stock investment in the USA, Stock Investment USA serves as a valuable platform. Explore a wealth of information, market analyses, and tools to enhance your investment strategy and stay ahead in the dynamic world of stock investment.

Conclusion: Building Wealth Through Strategic Stock Investment

In conclusion, strategic stock investment in the USA is a pathway to building wealth and achieving financial success. By understanding the basics, developing a strategic plan, diversifying, employing fundamental and technical analyses, staying informed, and accessing resources at Stock Investment USA, investors can navigate the complexities of the stock market and work towards their financial goals.